January is often a time when our clients take a look at their budgets for the year. When it comes to planning for your 2024 insurance costs, you’ve likely seen in the news – or experienced it firsthand – that insurance rates are going up.

Many factors are causing carriers to raise their rates right now, and no companies are exempt from these issues.

Nick and Meghan had no recent claims and saw a 30% rate increase in 2023; that’s fairly typical of what consumers are seeing right now.

The good news is that you have the McClain Insurance team on your side! Together, we have more than 100 years of insurance experience, and we’re eager to use that expertise to make sure that you get the best insurance value and maintain the coverage you need – more on that below.

First, some background on the current situation.

An Insurance “Hard Market”

You may have heard the term “hard market” being used to describe the current insurance industry. During a hard market, insurance companies raise rates to keep pace with rising costs, so they can continue to pay out claims. They pay to repair and rebuild houses, fix cars, and cover hospital bills for people who’ve been hurt in accidents. Like any business, insurance companies must raise rates when their costs rise.

During a hard market, customers also face more limited coverage options and stricter underwriting terms. Insurance is becoming costlier and finding the right coverage can be more challenging.

Hard markets are cyclical and difficult to predict, but this is the hardest market anyone on our team has ever experienced. What’s behind it?

5 Factors Contributing to the Hard Market

In Washington state, impacts have been especially significant. In 2018 and 2019, the Office of the Insurance Commissioner largely “froze” rates, meaning insurance companies were not able to adjust their pricing to reflect changes such as newer vehicle models, which are more costly to repair.

So we’re now seeing the first real rate increases in about five years – and a lot has changed in that time, including disruptions caused by the Covid pandemic.

Insurance rates are based on what an insurer thinks will be an adequate rate to make their customers whole in the event of a loss – whether it’s roof damage during a windstorm or a vehicle totaled during a traffic accident. As you’ve likely noticed, pretty much everything costs more than it did even a few years ago.

There are five major factors influencing today’s insurance costs:

1. Rising expenses in home reconstruction and vehicle repairs.

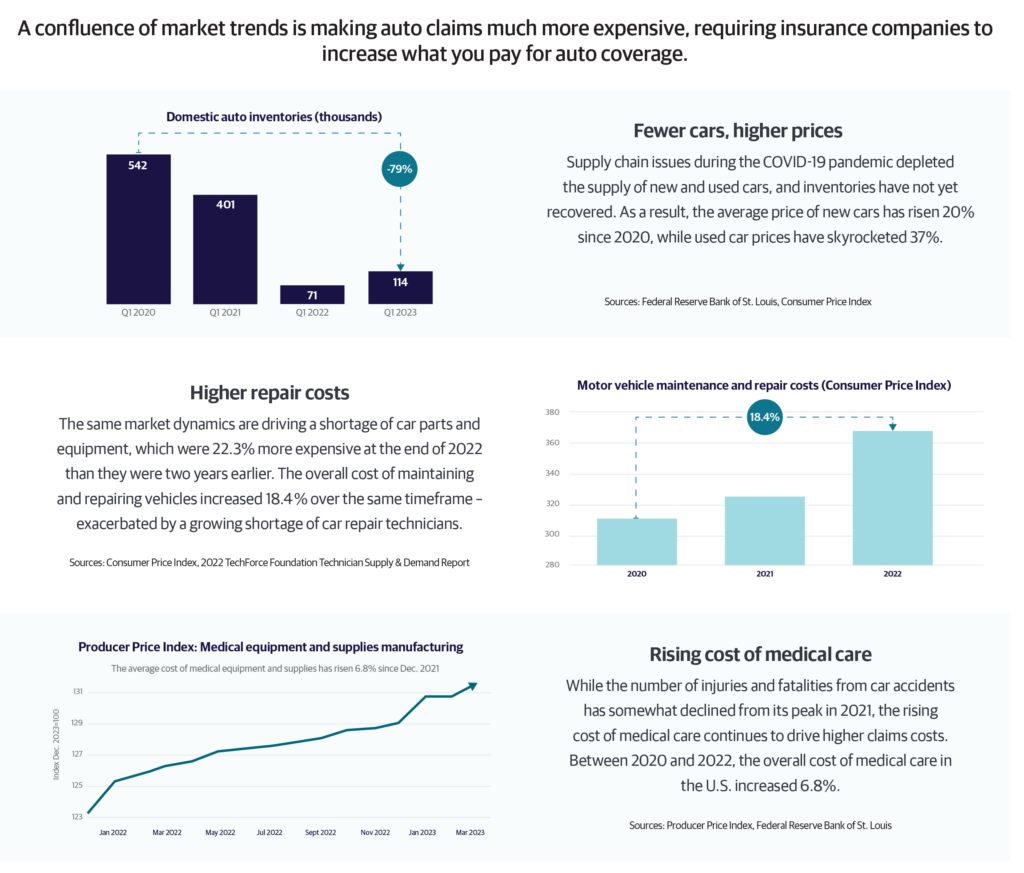

Ongoing supply chain issues are driving a shortage of car parts and equipment, which were 22.3% more expensive at the end of 2022 than they were two years earlier. The overall cost of maintaining and repairing vehicles increased 18.4 % over the same timeframe – made worse by a growing shortage of car repair technicians. The same issues depleted the supply of new and used cars during the COVID-19 pandemic, and inventories have not yet recovered. As a result, the average price of new cars has risen 20% since 2020, while used car prices have skyrocketed 37%.

We see similar issues on the home insurance front. If you’ve shopped for tools or building supplies lately, you may have experienced sticker shock. Last year, the cost of building materials rose 4.7%, reflecting a particularly strong uptick in prices on things like asphalt shingles (16.2%), concrete blocks (18.5%) and drywall (20.4%).

To make matters worse, the home-building industry is facing a shortfall of more than 300,000 skilled laborers, which is driving up construction-related labor costs. Combined with the high cost of construction materials and historically low housing inventory, home claims have become much more expensive for insurance companies.

2. Escalating medical and legal costs.

Today’s medical costs are significantly higher than they were just 10 years ago. Between 2020 and 2022, the overall cost of medical care in the U.S. increased 6.8%. We are also seeing increasing litigation costs related to injuries. From 2015 to 2020, the median cost of a jury award over $10 million increased by 35%, from $20 million to $27 million.

Significant and complex claims often have what we call a “long tail.” That means the true cost of the claim isn’t known for a long period of time, making it very difficult for insurance carriers to accurately set rates.

3. A post-pandemic increase in auto accidents and fatalities.

You may have noticed it yourself: Drivers seem to be driving faster and more aggressively post-pandemic. There are many theories about what’s behind this risky driving behavior, but the impact is clear: A recent USA Today article noted that traffic deaths hit a 16-year high in 2020. Speeding-related collisions increased by 11 percent and alcohol-related crashes rose 9 percent, even though there were fewer drivers on the road during the early pandemic.

“Estimates show 9,560 people died in car accidents during the first three months of 2022, up 7% from the same period in 2021 and the deadliest first quarter since 2002, [the Highway Traffic Safety Administration] said.”

4. More frequent and extreme weather-related claims.

The insurance industry has seen record-setting claim payouts and financial losses in recent years, caused by everything from hurricanes to unexpected cold snaps. In fact, 2022 was one of the costliest years on record for natural disasters, with more than $120 billion in insured losses. Insurance companies are raising rates to help pay for these significant losses and to provide financial stability in the event of future climate-related disasters.

Washington state residents face a variety of weather-related threats, including severe windstorms and wildfires. Homeowners in areas prone to extreme weather may see even higher premium increases as insurance carriers adjust their risk models.

5. Challenges in the secondary insurance market (reinsurance) due to nearing capacity.

In simple terms, “reinsurance” is insurance for insurance companies. Carriers transfer all or some of their risk to reinsurers. This secondary insurance market is being impacted by the same factors that primary insurance companies are. As a result, many are charging higher rates for their services or limiting coverage in certain areas.

Your McClain Insurance team is on your side

We know we haven’t painted a rosy picture so far. But the good news is that we are here to help.

You’re at the right place. Our team has decades of experience and we are skilled at helping you navigate challenges in the insurance market. We can help you find discounts and explore coverage options to make sure you are properly protected while still getting the best value for your insurance dollar.

Our team has long-standing relationships with the companies we represent, including PEMCO, Safeco, Travelers and Progressive. We can help you understand the available options and advocate on your behalf.

Before you shop, talk with us

When you’re facing a steep rate increase, it can be tempting to look for options elsewhere or to eliminate some of your policies.

We strongly encourage you to talk to us before you make any changes. It’s important to know that all insurance companies are affected by the hard market. Some companies have already adjusted their rates and others are still making changes. Switching insurance providers may mean losing out on loyalty discounts and accident forgiveness, particularly if you’ve been with your company for a long time. And changing carriers too frequently may make it harder for you to find coverage in the future.

Eliminating or changing coverages is an even greater risk. If you don’t have the protection you need in the event of a claim, you may face serious financial hardship.

5 Ways to Reduce Your Rates

Fortunately, there are steps you can take to offset increased rates:

- Opt for higher deductibles to save on premiums

- Utilize telematics programs and maximize any other discounts provided by your carrier, such as taking a driver safety course or installing home monitoring devices

- Pay premiums in full or enroll in EFT to avoid policy cancellation

- Consider reserving insurance for significant losses rather than small claims

- Bundle policies for muti-policy discounts

Clients Brent & Robyn Stapley got a discount on their home policy and prevented a leak from their water heater by installing a water detector

Remember, you don’t have to go it alone!

Our agents are dedicated to managing your insurance needs while staying within your budget. We continually evaluate market conditions and stay in touch with insurance carriers to keep you updated on pricing and coverage changes. Please contact us if you have questions or concerns about your coverage.

And if you know someone that we could help, please don’t hesitate to refer them to us. Your friends and family members are likely experiencing the same rate increases, and we would love to help them.

We are here to help! Contact us with any questions and let us put our century of experience to work for you!